The International Monetary Fund on Sunday warned governments to gear up for a possible economic storm as growth undershoots expectations.

"The bottom-line -- we see an economy that is growing more slowly than we had anticipated," IMF Managing Director Christine Lagarde told the World Government Summit in Dubai.

Last month, the IMF lowered its global economic growth forecast for this year from 3.7 percent to 3.5 percent.

Lagarde cited what she called "four clouds" as the main factors undermining the global economy and warned that a "storm" might strike.

The risks include "trade tensions and tariff escalations, financial tightening, uncertainty related to (the) Brexit outcome and spillover impact and an accelerated slowdown of the Chinese economy", she said.

Lagarde said trade tensions -- mainly in the shape of a tariff spat between the United States and China, the world's two biggest economies -- are already having a global impact.

"We have no idea how it is going to pan out and what we know is that it is already beginning to have an effect on trade, on confidence and on markets," she said, warning governments to avoid protectionism.

Lagarde also pointed to the risks posed by rising borrowing costs within a context of "heavy debt" racked up by governments, firms and households.

"When there are too many clouds, it takes one lightning (bolt) to start the storm," she said.

The “trifecta” of national, corporate, and consumer debt has reached all-time highs, and could prove to be catastrophic if a recession hits.

Let’s start by quickly bringing each part of this debt trifecta up to date as much as possible…

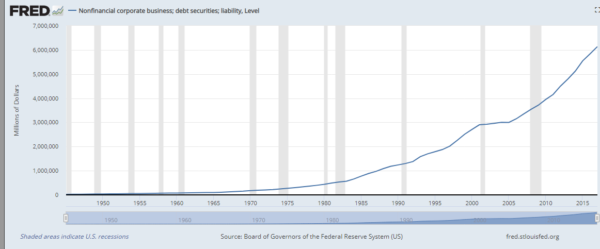

The total amount of corporate debt has never stopped rising since 1950. Corporations have taken on a record level of debt since 2007.

You can see the steady rise in corporate debt liabilities here:

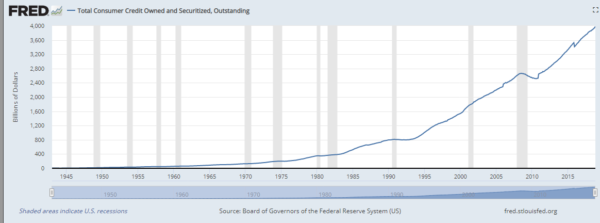

Total consumer debt is near $4 trillion, and has been rising steadily since 1975. But it has risen a staggering 47%since 2008, and shows no signs of stopping.

The chart below reveals this economic “ATM” at work:

Mainstream media almost never hype a financial crisis, so it’s significant when they do. But when billionaires are sounding the alarm, you might want to pay close attention.

At least two billionaires are doing just that, starting with Baupost Group’s Seth Klarman. Baupost Group is a $28 billion hedge fund, and Klarman normally positions himself out of the limelight. His fund is only open to private investors, so he has little incentive to promote his brand to the public.

But recently, he felt the need to write a warning to investors about the global debt, with specific reference to the U.S., according to Sovereign Man:

In a 22-page letter to his investors, Klarman warned that government debt levels, particularly in the US (where debt exceeds GDP), could lead to the next global financial crisis.“The seeds of the next major financial crisis (or the one after that) may well be found in today’s sovereign debt levels,” he wrote.

In the same letter, Klarman continued…

“There is no way to know how much debt is too much, but America will inevitably reach an inflection point whereupon a suddenly more skeptical debt market will refuse to continue to lend to us at rates we can afford…”

Since the U.S. spends almost a third of its revenue on interest payments alone, it doesn’t seem like it can afford to pay much more.

And Klarman isn’t the only billionaire expressing unease. At the World Economic Forum in Davos, Switzerland, Ray Dalio, founder of the world’s largest hedge fund, said that debt would be to blame for the next downturn, which he believes will be bigger than the Great Depression.

“The biggest issue is that there is only so much one can squeeze out of a debt cycle and most countries are approaching those limits”.

0 comments:

Post a Comment